National Securities Depository Limited (NSDL)

Brief Introduction

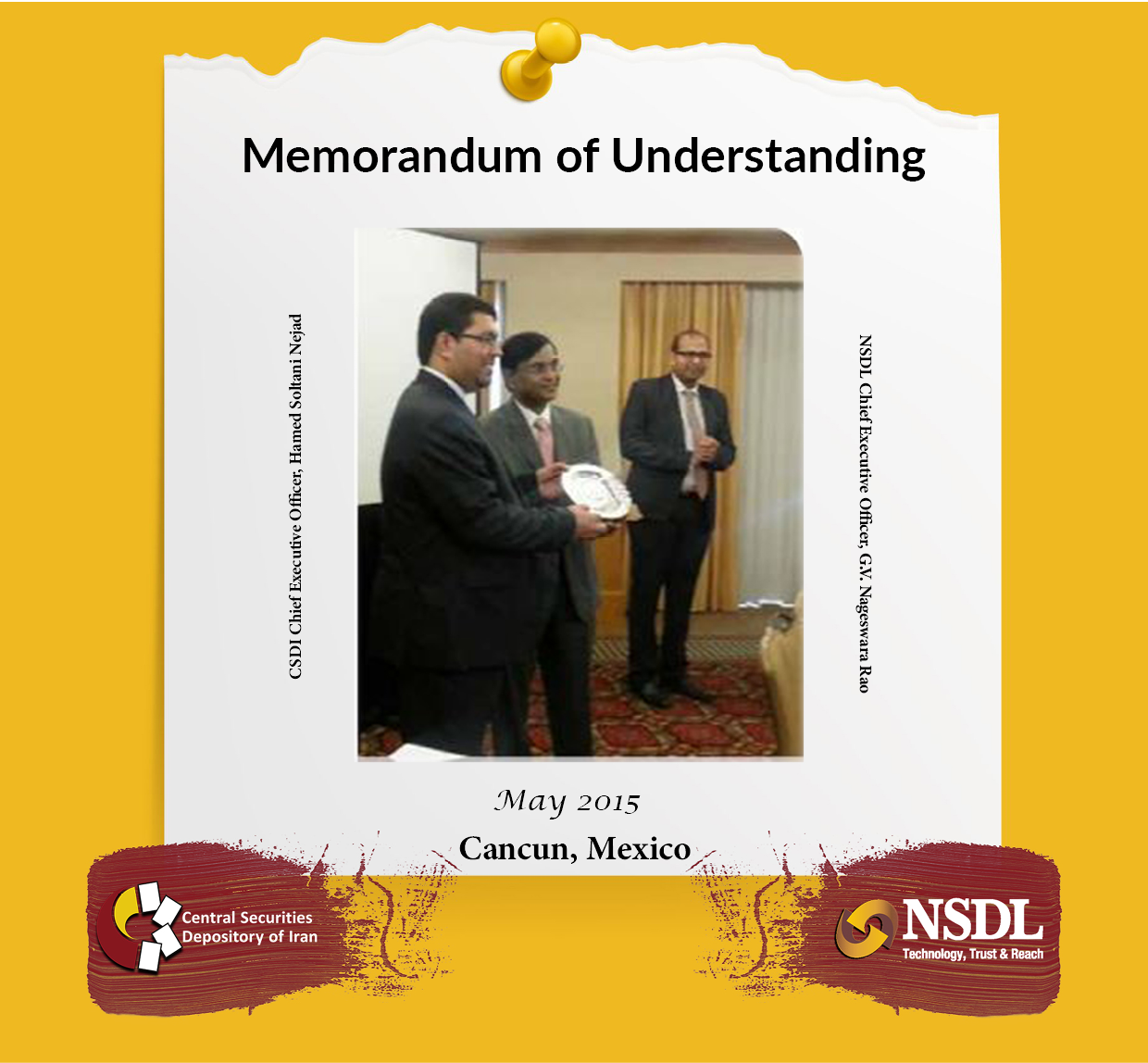

This Memorandum of Understanding between Central Securities Depository of Iran and National Securities Depository Limited (NSDL) was signed by the CSDI Chief Executive Officer, Hamed Soltani Nejad and the NSDL's CEO G.V.Nageswara Rao on the sidelines of the annual conference of the World Forum of CSDs (WFC) in Cancun, Mexico on 21 May 2015.

Objectives

- Making both parties' financial markets more prosperous and expansion of cross-border investments

- Expansion of communication and exchange of operational information between the two countries

- Exchange of operational statistics, reports and business models

An Introduction to National Securities Depository Limited (NSDL)

NSDL, one of the largest depositories in the World, established in August 1996 has established a state-of-the-art infrastructure that handles most of the securities held and settled in dematerialized form in the Indian capital market. Although India had a vibrant capital market which is more than a century old, the paper-based settlement of trades caused substantial problems like bad delivery and delayed transfer of title, etc. The enactment of Depositories Act in August 1996 paved the way for establishment of NSDL.

Using innovative and flexible technology systems, NSDL works to support the investors and brokers in the capital market of the country. NSDL aims at ensuring the safety and soundness of Indian marketplaces by developing settlement solutions that increase efficiency, minimize risk and reduce costs. At NSDL, we play a central role in developing products and services that will continue to nurture the growing needs of the financial services industry. In the depository system, securities are held in depository accounts, which is more or less similar to holding funds in bank accounts. Transfer of ownership of securities is done through simple account transfers. This method does away with all the risks and hassles normally associated with paperwork. Consequently, the cost of transacting in a depository environment is considerably lower as compared to transacting in certificates.

NSDL provides bouquet of services to investors, stock brokers, custodians, issuer companies etc. through its nationwide network of Depository Partners.

Joint Projects

CSDI, an ACG member since 2012, has become the grouping's board member since 2016. NSDL is also an ACG board member, the fact that paved the way for joint cooperation between the two companies in various areas, especially the exchange of knowledge and experience and the promotion of multilateral cooperation between the member companies. Also, CSDI and NSDL as co-members of the ACG’s "technical" working group started cooperation to expand and advance the services in members of the working group.

- Cooperation on Standardization of Mutual Fund Pre/Post-trade Operations

CSDI and NSDL are working jointly on the project of standardization of pre- and post-trade procedures for settlement operations of mutual funds, as well as on facilitating cross-border transactions related to the financial instrument in thirteen member countries of Asia Fund Standardization Forum (AFSF).