China Securities Depository and Clearing Corporation Limited (CSDC)

Brief Introduction

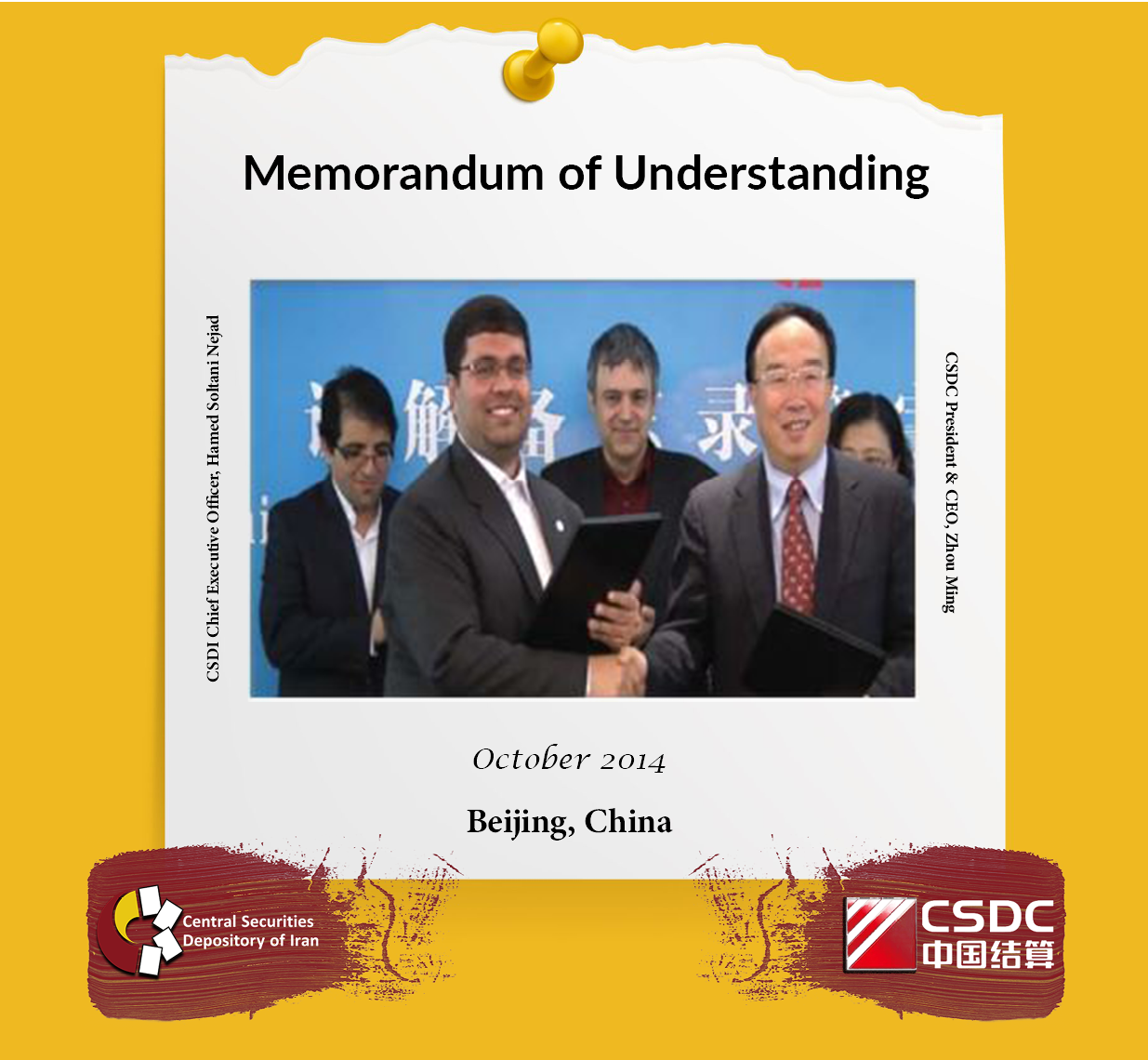

This Memorandum of Understanding between Central Securities Depository of Iran and China Securities Depository and Clearing Corporation (CSDC) was signed by the CSDI Chief Executive Officer, Hamed Soltani Nejad and CSDC President and CEO, Zhou Ming on the sidelines of the annual conference of the Asia-Pacific Central Securities Depository Group (ACG) in Beijing, China on 20 October 2014.

Objectives

- Further cooperation aimed at boosting prosperity of financial markets and cross-border investments

- Exchange of knowledge in CSD operations, transaction models and statistical reports

- The Linkage of two countries' capital markets and establishment of joint working groups

An Introduction to China Securities Depository and Clearing Corporation (CSDC)

With the approval of the CSRC, China Securities Depository and Clearing Corporation Limited (CSDC) was established on March 30, 2001, in line with the Company Law of the People’s Republic of China and the Securities Law of the People’s Republic of China.

CSDC is a non-profit-oriented corporation with Shanghai Stock Exchange and Shenzhen Stock Exchange as its shareholders, each holding 50% equities. As of 1 October 2001, the CSDC undertook all the securities registration, clearing and settlement business that used to be handled by Shanghai and Shenzhen Stock Exchanges, which marked the establishment of a centralized national securities registration and settlement framework prescribed by the Securities Law of the People’s Republic of China.

In accordance with the Company Law of the People’s Republic of China and the Chapter of CSDC, CSDC has set up Board of Shareholders, Board of Directors, Board of Supervisors and the Management Team. The head office of CSDC is made up of 15 departments (including 1 working team). CSDC has established CSDC Shanghai Branch, CSDC Shenzhen Branch, CSDC Beijing Branch, China Securities Depository and Clearing (Hong Kong) Corporation and China Securities and Futures Information Base Development and Construction Co. Ltd, which are the two wholly-owned subsidiaries of CSDC. China Securities Regulatory Commission (CSRC) is its supervisory authority.

The mission of the CSDC is to build a unified securities registration, clearing and settlement system in line with principles of safety and high efficiency, and to provide standardized, flexible and diversified registration, clearing and settlement services for various market participants which are involved in the investment and financing in the exchange and over-the-counter market, public and private fund market, cross-border securities cash and derivatives market according to the needs of developing the multi-layered capital market.

CSDC performs the following functions in line with relevant stipulations of Securities Law of People’s Republic of China and Measures for the Administration of Securities Registration and Settlement issued by CSRC and the Chapter of CSDC including.

Establishment and management of securities accounts and settlement accounts; Depository and transfer of ownership of securities; Registration of the register of securities holders as well as the registration of their rights and interests; Clearing and settlement as well as the relevant management of securities and funds; Distribution of securities rights and interests as instructed by the issuer; Providing inquiry, information, consultancy and training services relating to the securities registration and settlement business in accordance with law; and Undertaking of other business as approved by the CSRC.

Currently CSDC covers the following business scope:

1. Registration, clearing and settlement services for securities listed in Shanghai Stock Exchange, Shenzhen Stock Exchange and National Equities and Exchange Quotation;

2. Clearing and settlement services for securities options and other derivatives listed in Shanghai and Shenzhen Stock Exchanges;

3. Registration, depository, clearing and settlement services for cross-border securities trade such as Shanghai-Hong Kong Stock Connect.

4. Registration, clearing, settlement and custodian services for open-ended fund listed in the mainland market (CSDC accounted for 25% market share), and asset management products by securities companies, Mainland-Hong Kong Mutually- Recognized funds;

5. Registration, clearing and settlement services for margin financing loan business by China Securities Finance Co., Ltd. ;

6. Physical delivery services for T-bond futures listed in China Financial Futures Exchange;

7. Centralized registration and depository services for non-listed public companies;

8. Centralized registration and depository services for non-overseas listed shares by the overseas-listed companies (mainly in Hong Kong);

9. Cross-market custodian and registration transfer services for the bonds transferring between Exchange Market and Inter-bank Market.

CSDC mainly provides the registration and settlement participants with the following services:

1. Registration of the register of securities holders, distribution of securities and interests, services for corporate actions like online voting, Stock Incentive Compensation and ESOP by securities issuers.

2. Setting up securities account for the securities holders through the electronic securities book entry system, and also providing the registration, depository and post-trade settlement services.

3. Setting up guaranteed and non-guaranteed capital accounts for clearing participants, and providing clearing and settlement services for securities and financial derivatives; providing multilateral guaranteed netting clearing and settlement services for securities collectively traded in exchange market as the CCP; Providing bilateral gross settlement, bilateral netting settlement, RTGS and agent payment services for securities not collectively traded in the exchange market;

4. Providing custodian services of fund for the private and public fund issuers.

Joint Projects

CSDI, an ACG member since 2012, has become the grouping's board member since 2016. CSDC is also an ACG board member the fact that paved the way for joint cooperation between the two companies in various areas, especially the exchange of knowledge and experience and the promotion of multilateral cooperation between the member companies. Also, CSDI and CSDC as co-members of the ACG’s "Law and Regulations" working group started cooperation to expand and a https://www.ksei.co.id/events/afsf?setLocale=en-US#:~:text=The%20AFSF%20itself%20is%20a,Group%20(ACG)%20General%20Meeting. advance the legal frameworks in members of the working group.

- Cooperation on Standardization of Mutual Fund Pre/Post-trade Operations

CSDI and CSDC are working jointly on the project of standardization of pre- and post-trade procedures for settlement operations of mutual funds, as well as on facilitating cross-border transactions related to the financial instrument in thirteen member countries of Asia Fund Standardization Forum (AFSF).