National Clearing Company of Pakistan Limited (NCCPL)

Brief Introduction

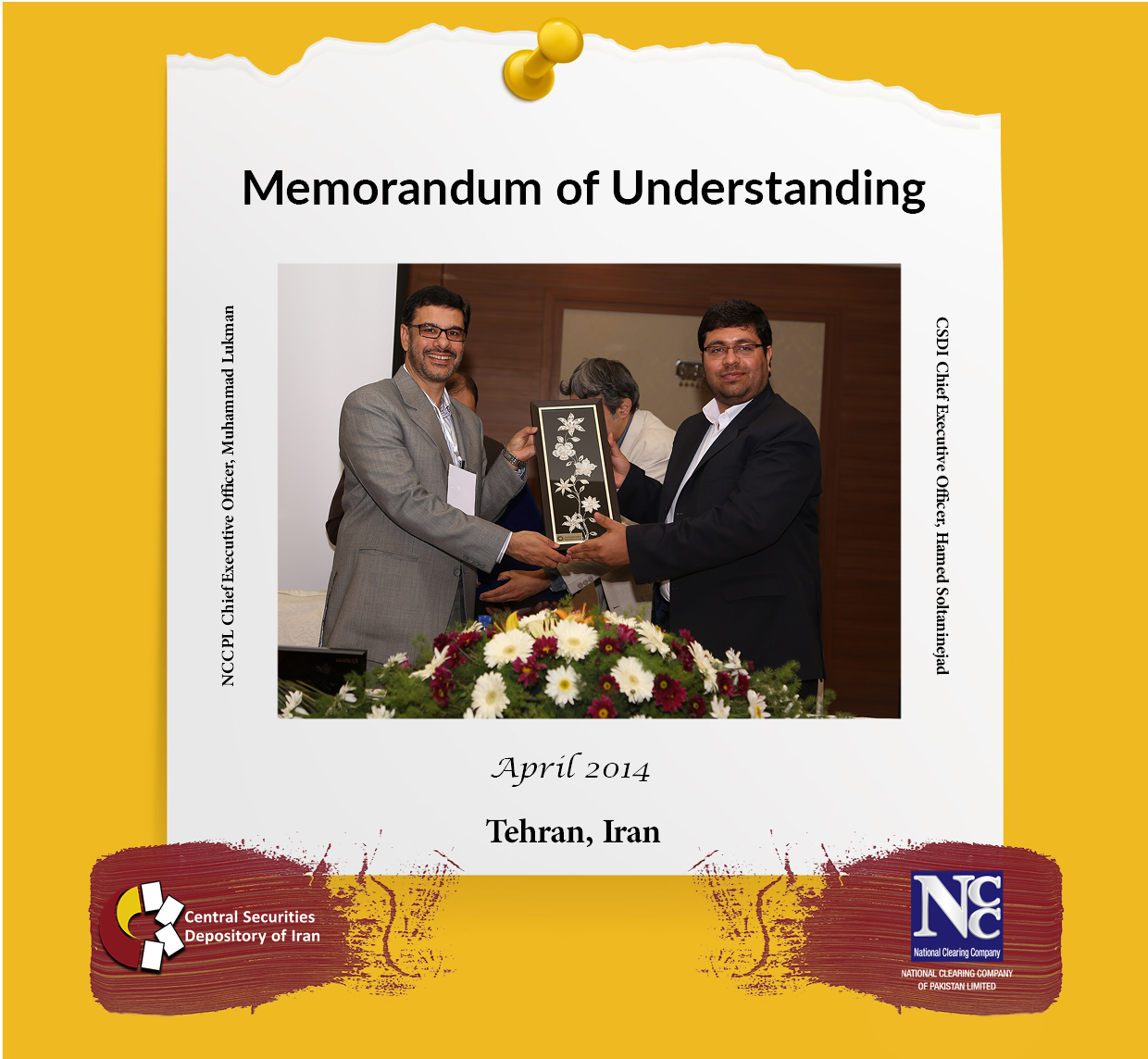

This agreement has been reached between Central Securities Depository of Iran and National Clearing Company of Pakistan on 27 April 2014 during an official visit by NCCPL Chief Executive Officer to the CSDI headquarters in Tehran, Iran.

Objectives

- To expand multilateral ties between markets entities

- Knowledge sharing in legal and regulatory matters, systems, operations, and executive processes

An Introduction to National Clearing Company of Pakistan (NCCPL)

National Clearing Company of Pakistan Limited (NCCPL) was incorporated on July 3, 2001, in order to replace the separate and individual clearing houses for Pakistan's three Stock Exchanges, namely Karachi Stock Exchange, Lahore Stock Exchange, and Islamabad Stock Exchange by a single and centralized entity. In 2016, these three stock exchanges were integrated to form Pakistan Stock Exchange (PSX). Accordingly, NCCPL now offers clearing, settlement, and risk management services for trades being conducted in PSX.

NCCPL is a public unlisted company, in which PSX holds approximately 47.06% of NCCPL shares, followed by LSE Financial Services Limited (formerly Lahore Stock Exchange) holding (23.53%), Pakistan Kuwait Investment Company holding (17.65%) and Pakistan ISE Towers REIT Management Company (formerly Islamabad Stock Exchange) holding (11.76%) of NCCPL shares.

NCCPL is headquartered in Karachi, with branches in Lahore and Islamabad.

NCCPL has a strong governance structure and a qualified and experienced management team. NCCPL’s Board of Directors comprises 13 members including four independent directors, with all of them are non-executive directors except for the CEO. The NCCPL’s Board has constituted various committees to focus on key financial and operational functions, such as Audit Committee, HR Committee, and IT Steering Committee.

Since its incorporation, NCCPL has established itself over the span of 19 years as a fundamental institution in Pakistan's capital market infrastructure. This achievement is based on NCCPL's prudent strategy and focuses on utilizing the expertise gained over the period in developing and implementing services to the benefit of capital market participants. Apart from clearing and settlement operations, key services offered by NCCPL are briefly highlighted below:

- Since May 2016, NCCPL has started to act as Central Counter Party (CCP) after it established a Settlement Guarantee Fund (SGF) to take its new role in the Pakistani capital market.

- NCCPL is also considered as the Risk Management Entity in the Pakistani capital market.

- Registration of investors through allocating Unique Identification Number (UIN) for each investor.

- Act as an Authorized Intermediary by providing a platform for leverage services, including margin trading, margin financing, short selling lending and collateralizing the securities.

- Launching the Automated CGT System for calculating, determining and collecting CGT on securities trading since April 2012.

- Providing Known Your Customer (KYC) services regulated by the Centralized Know Your Customer Organization (CKO) since 2017. NCCPL obtains KYC information of clients at the time of account registration by brokers and issues Unique KYC Number (UKN) on completion of verification and confirmation process.

NCCPL also enjoys the state-of-the-art technology infrastructure and it holds the following international certification and accreditations:

- ISO 27001 Information Security Management System - Certified since 2011. The first company in Pakistan to upgrade certification of 27001:2005 standard to 27001:2013.

- ISO 23001 Business Continuity Management System - Certified in 2017; one of the two companies to get certified in Pakistan.

- Audited by SGS, a world-renowned firm, and certified by UK-based accreditation body, UKAS.

Joint Projects

- Joint Cooperation in the Framework of Asia-Pacific CSD Group (ACG)

Central Securities Depository of Iran has been a member of the Asia-Pacific CSD Group (ACG) since 2012 and it has joined the Executive Committee of ACG since 2016. National Clearing Company of Pakistan (NCCPL) is also a member of ACG and this co-membership has provided the common ground for various areas of cooperation between CSDI and NCCPL particularly on the exchange of information and expertise and joint work to promote multi-lateral cooperation among ACG members.